AI Call Center Compliance: 6 Best Practices for Auditing and Risk

Call centers face mounting pressure to maintain compliance across thousands of daily interactions. With regulations tightening across industries, Quality Assurance (QA) teams struggle to audit enough calls to ensure consistent adherence.

Manual sampling methods leave critical gaps, and by the time issues surface, compliance violations may have already occurred, potentially leading to massive financial penalties. The average cost of non-compliance is nearly $9.4 million, compared to $3.5 million for compliance.

Why Traditional Compliance Auditing Falls Short?

Manual QA processes, which often manage to review less than 2% of interactions, create predictable and costly vulnerabilities:

- Limited Sample Coverage Means Blind Spots: Auditors can only evaluate a tiny fraction of calls. Significant compliance gaps remain invisible until they become costly problems, with potential fines reaching as high as $53,088 per violation for rules like the Do Not Call (DNC) Registry.

- Subjective Interpretation: Different auditors evaluate the same interaction differently, creating inconsistent compliance data that is difficult to defend during regulatory reviews.

- Delayed Feedback Loops: When agents learn about compliance issues days or weeks after the interaction, the opportunity for immediate correction has passed—and similar violations may have already repeated across dozens of calls, multiplying your risk.

- Reactive Posture: Inconsistent adherence tracking makes it difficult to identify systemic problems versus individual agent issues, leaving compliance teams perpetually reactive rather than proactive.

Understanding AI-powered Compliance Auditing

AI-powered compliance auditing uses pattern detection, speech-to-text analytics, and rule-based analysis to review interactions at scale. These systems can identify script deviations, flag missing disclosures, detect sentiment anomalies, and highlight potential compliance risks across 100% of interactions.

Importantly, AI Quality Management Systems support human auditors rather than replacing them. The technology handles high-volume screening and pattern identification, while compliance professionals focus on nuanced judgment calls, coaching, and strategic risk management.

The Governance Foundation: Trustworthy AI

As AI becomes central to operations, its governance is paramount. Robust AI QA systems must adhere to global principles like the NIST AI Risk Management Framework. This ensures:

- Transparency: Always being able to show exactly how an AI system reached a compliance decision.

- Bias Mitigation: Ensuring that QA scoring models are fair, unbiased, and apply compliance rules consistently across all agents and customer demographics.

AI-powered Auditing Best Practices for Call Center Compliance

Implementing an AI-Powered Quality Management System requires a strategic approach. Here are six core practices your compliance team must follow to maximize effectiveness:

1. Expanding Audit Coverage Without Expanding Your Team

The most immediate benefit of AI auditing is comprehensive coverage. By reviewing every interaction against compliance rules, you eliminate the blind spots inherent in sampling-based approaches. This transforms compliance from a sampling exercise into a complete monitoring framework, providing defensible evidence that all interactions are evaluated consistently.

2. Create Clear, Machine-Readable Compliance Rules

AI systems perform best with unambiguous compliance criteria. Ambiguous rules create false positives and undermine trust.

To ensure the highest accuracy, translate your compliance mandates into actionable IF-THEN logic:

- Example Rule Structure: IF Agent collects Personal Information (PHI/NPI) THEN Agent must state the full security disclosure verbatim AND must obtain explicit, verbal consent (documented via timestamp).

Well-defined rules produce consistent AI output and provide clear regulatory compliance, which is critical when facing large penalties.

3. Prioritize Real-time or Near Real-time Compliance Alerts

Speed matters immensely in compliance. Real-time alerting enables immediate intervention when high-risk patterns emerge supervisors can join a call if a critical disclosure is missed, or an agent can be coached immediately after an interaction rather than days later.

Faster corrections mean lower risk exposure and more effective learning, especially given that major fines (like €20 million for GDPR violations) are often tied to systemic failures that AI can prevent in real-time.

4. Automate Detection of High-risk Patterns

Breaches with a noncompliance factor cost $174K more on average. To avoid these challenges, configure your AI Quality Management System to automatically identify and escalate the highest priority compliance concerns.

Automated escalation ensures your compliance team focuses its limited human attention where risk is highest, maximizing their impact and reducing the average cost of a data breach, which is estimated to be over $4.4 million globally.

5. Transforming AI Insights into Targeted Agent Coaching

AI-powered auditing generates rich data, but data alone doesn’t change behavior. The unfortunate reality of traditional QA is that managers spend 75% of their coaching time re-coaching because agents need an average of four sessions to implement a new skill. The most effective systems connect AI findings directly to coaching workflows.

- Precision Coaching: AI pinpoints the exact 15 seconds where the agent missed a mandatory disclosure.

- Accelerated Learning: Real-time, personalized feedback accelerates an agent’s learning curve. When leaders dedicate time to this kind of targeted, data-driven coaching, it has been shown to improve agent productivity and significantly reduce costly agent turnover.

- Targeted Sessions: This transforms AI from a monitoring tool into a performance development engine that drives adherence.

6. Maintain Transparent Audit Trails for Regulatory Proof

During regulatory reviews or internal audits, you need to demonstrate not just that you have compliance processes, but that those processes work consistently.

AI QMS provides complete audit trails: which interactions were reviewed, which machine rules were evaluated, what scores were assigned, and what corrective actions were taken in response to the findings. This is non-negotiable evidence for regulators.

Two Biggest Objections to AI QMS

To secure buy-in, compliance leaders must address the two primary concerns: cost (ROI) and team anxiety.

Objection 1: “AI is Too Expensive—What’s the ROI?”

The total cost of financial crime compliance reached $61 billion in the U.S. and Canada. The true ROI is in scalability and risk mitigation.

- Risk Avoidance: Avoiding a single major violation (e.g., a $53,088 TCPA fine) can easily justify the annual cost. Furthermore, non-compliance costs are often more than twice the cost of maintaining compliance.

- Labor Efficiency: AI handles the routine, high-volume scoring, freeing human auditors to focus on complex, strategic risk management and coaching. This focus is reported to yield significant returns, with Auto QA solutions often providing a 300% to 400% ROI within the first year by lowering QA labor costs.

Objection 2: “Will AI Replace My Human QA Auditors?”

AI elevates human QA professionals in the following way:

- AI Automates Detection; Humans Provide Judgment: AI takes over the tedious, repetitive work of listening to hours of calls, finding 2-3% that need attention.

- Elevated Roles: QA auditors are freed from manual scoring to become true Compliance Strategists. Their new focus is on Root Cause Analysis, Advanced Coaching, and continuously refining the AI’s machine-readable rules to adapt to new regulatory changes.

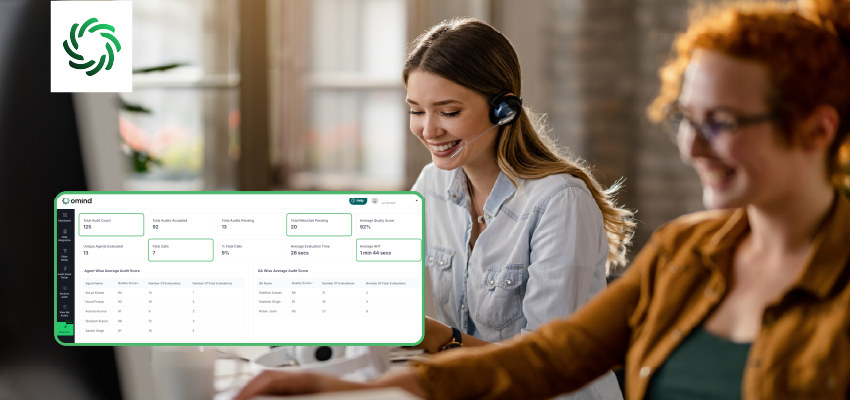

AI doesn’t replace people but equips your existing QA team with superhuman monitoring capabilities. The AI QMS by Omind allows them to transition from being call-listeners to being high-impact compliance risk managers and performance coaches.

Conclusion

Call center compliance removes risks about creating consistent processes. AI-powered auditing best practices don’t replace your compliance expertise; they extend your team’s reach, allowing you to monitor comprehensively while focusing your attention on the patterns that matter most.

As regulatory expectations continue to intensify, organizations that embrace AI-supported compliance auditing gain a sustainable advantage: better coverage, faster response times, and stronger evidence that their quality assurance processes work as intended.

Are you interested in evaluating how AI-powered auditing best practices fit your compliance workflows? Book a short demo to see our platform in action.